"Our collaboration group is in the organisation of helping distressed homeowners to stop foreclosure sale dates and assist these homeowners to apply for House Loan Adjustments which lower rates of interest and payments. We discover that the terms we utilize to discuss this process for saving houses and getting house owners back current on their loans are unknown to many people. This is since they deal with the process of buying a house just really rarely in their lifetime.

Below are a few of the most typical terms for dealing with Foreclosures and Mortgage Adjustments

Foreclosure: This is a process by which your lender repossesses your house when you default on the terms of the cash that your Lender lent to you to spend for your house when you acquired it.

Loan Officer: The Licensed Professional who helped you to organize your loan and the terms of that loan.

Mortgage Broker: This term uses to the business that the Loan Officer works for, and which scheduled a Lender to loan you the cash to money your home purchase. This can be the same company as the Loan provider. You might have utilized a Home loan Broker to help you get a loan, or you might have used a Loan Officer who works directly with the Lender. In either case, the money was moneyed by the Loan provider.

Principal Balance: This is always the amount of money that you still owe on your house after each payment. The Principal Balance is minimized with each payment by the quantity of the payment which approaches Principal Balance. The month-to-month interest is always charged on the Staying Principal Balance and not on the original loan amount.

Promissory Note: The file that a Customer signs, new fidelity funding which is precisely as it sounds. It is your guarantee to pay the lender back the cash, that was loaned to purchase the home described and the regards to that loan. These terms would consist of products such as rates of interest; length of the loan; Principal (obtained quantity); Monthly Payments etc. Promissory Notes can be utilized for many other kinds of loans that houses and genuine estate. But Promissory Notes are constantly utilized for home purchases.

Rates of interest: This is the portion rate that you are paying the Lending institution for utilizing and keeping the cash that was lent to you. This interest generally charged as an annual rate however paid monthly. The month-to-month payment that you pay consists of both the payment towards the interest owed (this is the Lending institution's revenue) and payment toward the Principal Balance which stays to be paid.

Fixed-Rate Loan: This is a loan that constantly preserves the very same rates of interest on the Principal Balance for the life of the loan. Many home loans are 15-year loans or 30-year loans. There are 180 equal month-to-month payments in a 15-year loan. There are 360 equal regular monthly payments in a 30-year loan.

Adjustable-Rate Loan (ARM): Adjustable Rates Of Interest Loans (Adjustable Rate Home mortgage) are understood by their acronym ARM. ARM loans change up or down according to the terms of loan. If the rates of interest of an ARM loan adjusts upward to a greater interest rate, then your monthly payment will increase. If the interest rate changes downward to a lower interest rate, then your month-to-month payment will decrease. Many ARM loans are connected to other kinds of interest, so they rise when rate of interest fluctuate as interest rates fall. Throughout the last ten years, lots of ARM Loans were connected to period and would increase simply because a particular time duration had actually passed. These loans only go up and do not rise and fall with the economy.

Home loan: In some cases utilized to imply the very same thing as the word ""loan"", although this not proper. This is the document that you signed which created the loan and loan terms. This is tape-recorded at your Court house and which the Lender utilizes to show why they are legally the Entity that lent you the loan for your home. This likewise is the file that includes the terms that allow the loan provider to reclaim your home if you do not pay for it. This document is generally utilized in States that use Judicial or ""claim"" foreclosure. It normally takes longer to foreclose in these states but can have higher negative result on the foreclosed Borrower.

Deed of Trust: This product is a file similar to ""Home loan"" above. It is utilized in the Non-Judicial Foreclosure States. The Deed of Trust is a recorded file signed by you and the Loan provider which describes your Loan (Promissory Note) and provides the Lender the right to sell your house at auction if you default on your loan. In these States, the Lending institution does not have to take you to court. A normal default would be a failure to make your payments on time to the Loan provider.

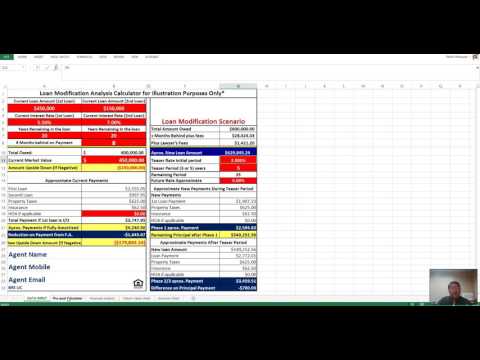

Mortgage Adjustment Process: The concept of Loan Adjustment is not brand-new, but the use of it definitely was extremely rare traditionally compared to the extensive use of the procedure today. Due to the really big number of badly written loans over the last 10 years and the very high current foreclosure rate, Lenders are seeing the need to try to get property owners into month-to-month payments that are economical. Each foreclosure costs a Lending institution a lot of cash and injures the worth of houses everywhere. It normally thought today that changing a few of the regards to a home mortgage to decrease the payment is preferable to foreclosure. A Home Mortgage Modification does precisely this, it changes the interest and month-to-month payment to keep the owner in a budget friendly situation."