Loan adjustment is a revision in regards to a loan which leads to modifications in rates of interest, the primary amount or perhaps the type of loan program you are on.

Traditionally, basic refinance is more common as compared to loan modification. The need for altering the conditions or regards to the loan is basically due to the difficulty the borrower might be facing in paying back the loan as per the originally concurred regards to the loan. Homeowners that default in payments have extremely tough decisions to take as a repercussion to the default. Some of the choices available are a) foreclosure; b) short sale or c) Loan adjustment. Of these there alternatives it is only under loan adjustment that the homeowner can retain possession of the home. In such a case, if the borrower is able to prove that they can make great the payment under revised terms, in a constant and timely way, will the bank think about allowing a loan adjustment. The modification in terms could be increasing the amortization period (40 or 50 years), principal balance reduction, forbearance clause, short-lived or irreversible interest rate reductions or including an interests just alternative. (please refer to the Glossary for a much better understanding of the italicized words).

The fundamental objective of loan adjustment is to permit the house owner the opportunity of making the specific quantum of payment that he/she can reasonably pay after thinking about all monthly expenses. The bank would think about all aspects of the customer's costs like phone payments, credit card liabilities, electrical power, gas and water charges and the like. The bank would not require the borrower to invest all his month-to-month income on financing the home mortgage as this is virtually not feasible and reasonable. Hence, the loss mitigation department of the bank will consider all sensible expenses for keeping a normal lifestyle while computing a reasonable month-to-month mortgage payment requirement.

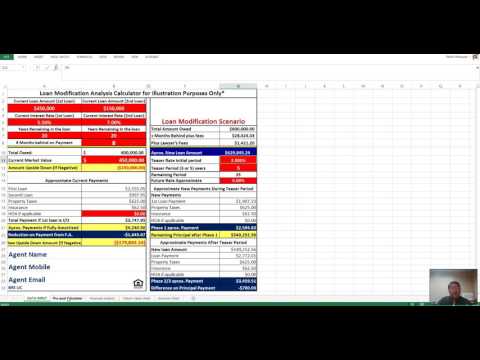

Loan adjustment is a settlement procedure in between the borrower (you, the homeowner) and your loan provider (the bank). Sometimes you may have an adjustment business handle the count on your behalf. The procedure involves submission of a proposition in addition to an Earnings Vs. Expenditures Declaration which you will see in the worksheet at the end of this book. This declaration provides to the lender the amount overall of your family earnings post taxes. Also, there is an estimation of your month-to-month expenses that include hard in addition to soft costs. Softy expenditures are not so simple to identify and record. If the soft costs are overestimated, you will be able to approximate the money. The Earnings Vs. Cost Declaration provides your month-to-month income which you can then compare with the costs excluding the home mortgage payments. The distinction in between the overall income and the costs amounts to the revised month-to-month home mortgage, with the understanding that you would have left some surplus for incidentals in your cost side while preparing the loan adjustment proposal. Leaving nothing for incidentals is not at all useful.

Settlement with the loan provider is the action that follows presentation of the loan modification proposition including the Earnings Vs Expenditures worksheet. Negotiations will be dealt with later in this book.

Principle balance decrease having 1st and second Home Mortgage

When you have first and trust deed holders, pursuing and getting principal balance decreases end up being easier, mainly due to the fact that the 2nd trust deed holder will get barely anything when it comes to foreclosure. When a foreclosure happens, the first deed holder is paid off and just any recurring amount makes money to the new fidelity funding yelp 2nd holder. In many cases, the second holder is confronted with huge losses and recuperates really little, of any. That's why the 2nd holder favors enabling some reduction. As the bank wishes to get at least 10-20% they would definitely not like a situation where you lose your home and they make losses, due to which they wish to prevent such an occurrence by any ways.

When you have 2 home mortgages holders you can have 2 conditions:

a) Where both notes are held by one bank and b) where the 2 notes are owned independently by 2 different banks. The very first situation is best for a principal balance decrease. They would rather securitize the very first because the 2nd is primarily of no value to the lending institution. The second might be brought down as low at one-tenth (10%) of what is currently exceptional offered they are encouraged that you can settle in time and regularly. Seldom would a bank reduce both the first and the second when payments are in jeopardy.

Reductions can be different if both mortgages are held by different banks. A bank that http://edition.cnn.com/search/?text=https://www.quickenloans.com/mortgage-education/refinance-guide owns simply the 2nd would look at the single note to establish losses. If a bank holds both keeps in mind, it would be reasonable to anticipate that the bank would forgive up to 90% of the 2nd to avoid larger losses. However second trust deed holders recognize that on foreclosure they would lose all, so they would allow principal balance decrease, despite the fact that it might not be simple. This realization frequently prompts the second holder to press for a negotiation and avoid foreclosure.

If you want a favorable settlement you have to encourage both banks to lower the balance as this might work out well not just for you by spreading out the losses however also for the banks.

If you wish to deal with a modification business, beware that you do not get cheated to add to all your debt issues.